Ofgem

|

|

Energy price cap will rise by 1.2% from January

Energy regulator Ofgem has today (Friday 22 November) announced a 1.2% increase of the energy price cap for the period covering January-March 2025.

The change to the price cap – which sets a maximum rate per unit and standing charge that can be billed to customers for their energy use – will rise by £21 for an average household per year or around £1.75 a month.

For an average household paying by Direct Debit for dual fuel this equates to £1,738 per year. This is 10% (£190) cheaper compared to January-March 2024 (£1,928) and 57.2% (£2,321) less than the energy crisis (January-March 2023).

It comes as analysis by Ofgem shows around 1.5million households switched tariff over the past three months. The regulator is urging customers to take advantage of the rising choice in the market and look for the best deal to help keep their household bills down. By switching, savings of up to £140 are currently available.

Following a call by Ofgem in August for suppliers to offer more choice with low and no-standing charge tariffs, there has been an increase in the number of suppliers offering these kinds of deals. There are currently 8 available that are at least 10% below the level set in the price cap.

However, while these come with a lower standing charge, they do have a higher unit rate. They could benefit customers with lower energy usage but will not work for everyone so consumers should carefully consider what works for them.

Tim Jarvis, director general of markets at Ofgem, said:

“While today’s change means the cap has remained relatively stable, we understand that the cost of energy remains a challenge for too many households. However, with more tariffs coming into the market, there are ways for customers to bring their bill down so please shop around and look at all the options.

“Our reliance on volatile international markets - which are affected by factors such as events in Russia and the Middle East – means the cost of energy will continue to fluctuate. So it’s more important than ever to stay focused on building a renewable, home-grown energy system to bring costs down and give households stability.

“In the short term though, anyone struggling with bills should speak to their supplier to make sure they’re getting the help they need and look around to make sure they’re on the best, most affordable deal for them.”

The regulator is encouraging customers to consider the way they pay their bills. Around 5 million customers pay by standard credit payments – which means paying for energy after it has been used. But this is much more expensive, particularly over the winter months. Customers could save £100 by simply switching from standard credit payments to Direct Debit payments or smart PPM, which remains the cheapest way to pay for energy.

The cheapest deal on the market could save a typical dual fuel customer £210 compared to the upcoming price cap level. However, this requires signing up for an additional boiler cover service.

There are other cheaper fixed deals on the market which don’t require additional services that could save customers more than £140 per year compared to the upcoming cap level.

If consumers are worried about paying their bills, they can contact their supplier for support. Ofgem’s rules mean they must work with their customers to agree an affordable payment plan. They may also be able to help by offering more time to pay, access to hardship funds and advice on how to use less energy.

Notes to editors

Ofgem recently launched its new consumer confidence programme which will focus on defining the outcomes it wants the sector to deliver, redesigning the regulations and incentives to deliver those outcomes, and ensuring Ofgem has the right powers. This builds on Ofgem’s Consumer Interest Framework which aims to ensure fair prices, a high-quality service, a low-cost transition to net zero and a resilient sector. This includes rules to make contacting suppliers for help with bills quicker and easier.

The energy price cap was introduced by the government and has been in place since January 2019, and Ofgem is required to regularly review the level at which it is set. It ensures that an energy supplier can recoup its efficient costs while making sure customers do not pay a higher amount for their energy than they should. The price cap, as set out in law, does this by setting a maximum that suppliers can charge per unit of energy.

New number of customers on Standard Variable Tariffs (SVT) – ‘around 26 million’ of which:

- New number of SVT Direct Debit customers – ‘around 16 million’

- New number of SVT Standard Credit customers – ‘around 5 million’

- New number of SVT PPM customers – ‘around 4 million’

Total number of customers on fixed tariffs ‘around 7 million’ (with the vast majority being non-PPM)

Latest Financial Responsibility RFI data is for October 2024. Tariff and customer Account RFI data is as of October 2024 (used to calculate the SVT payment splits).

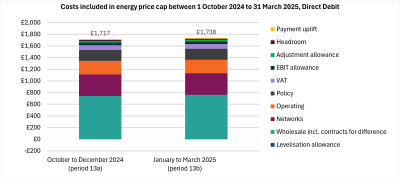

Costs included in energy price cap between 1 October 2024 and 31 March 2025, Direct Debit

Changes to costs included in the energy price cap between 1 October 2024 and 31 March 2025, Direct Debit

| Cost | October to December 2024 (period 13a) | January to March 2025 (period 13b) | Change (£) | Change (%) |

|---|---|---|---|---|

| VAT | £82 | £83 | £1 | 1.2% |

| Earnings Before Interest and Tax (EBIT) allowance | £43 | £43 | £0 | 0.7% |

| Payment uplift | £16 | £16 | £0 | 0.6% |

| Adjustment allowance | £28 | £28 | £0 | 0.0% |

| Headroom | £18 | £18 | £0 | 1.6% |

| Policy | £187 | £187 | £0 | 0.0% |

| Operating | £232 | £232 | £0 | 0.0% |

| Networks | £370 | £370 | £0 | 0.0% |

| Wholesale incl. contracts for difference | £736 | £755 | £19 | 2.6% |

| Levelisation allowance | £7 | £7 | £0 | -0.5% |

| Total | £1,717 | £1,738 | £21 | 1.2% |

Figures may not sum to total due to rounding.

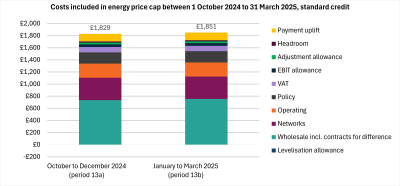

Costs included in energy price cap between 1 October 2024 and 31 March 2025, standard credit

Changes to costs included in the energy price cap between 1 October 2024 and 31 March 2025, standard credit

| Cost | October 2024 to December 2024 (Period 13a) | January 2025 to March 2025 (Period 13b) | Change (£) | Change (%) |

|---|---|---|---|---|

| VAT | £87 | £88 | £1 | 1.2% |

| Earnings Before Interest and Tax (EBIT) allowance | £44 | £45 | £0 | 0.7% |

| Payment uplift | £125 | £126 | £1 | 0.9% |

| Adjustment allowance | £28 | £28 | £0 | 0.0% |

| Headroom | £20 | £20 | £0 | 1.5% |

| Policy | £187 | £187 | £0 | 0.0% |

| Operating | £232 | £232 | £0 | 0.0% |

| Networks | £370 | £370 | £0 | 0.0% |

| Wholesale incl. contracts for difference | £736 | £755 | £19 | 2.6% |

| Levelisation allowance | £0 | £0 | £0 | 0.0% |

| Total | £1,829 | £1,851 | £22 | 1.2% |

Figures may not sum to total due to rounding.

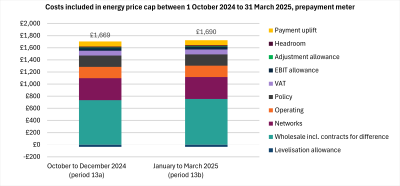

Costs included in energy price cap between 1 October 2024 and 31 March 2025, prepayment meter

Changes to costs included in the energy price cap between 1 October 2024 and 31 March 2025, prepaym

Original article link: https://www.ofgem.gov.uk/press-release/energy-price-cap-will-rise-12-january